The REIT Acquires Outparcels

Outparcels are freestanding buildings located in prominent locations with direct frontage on high-traffic roads that are visible to consumers. Our outparcel properties are typically leased to service focused and e-commerce resistant super regional brands under long-term lease agreements.

Our ABS Notes Have An Investment Grade Rating “A” from Standard & Poor’s and Kroll Bond Rating Agency

Why FrontView REIT?

Resilient

Portfolio Occupancy rate of 98.8% as of September 30, 2023.

“Real Estate First” Investment Strategy

Highly differentiated investment strategy that includes a carefully considered set of criteria

Expertise

An average of more than 20 years of real estate and/or net lease real estate experience

FrontView REIT’s “Real Estate First”

Investment Strategy

-

Prime Properties in Desirable High-Traffic Locations.

-

E-Commerce Resistant Tenants.

-

Favorable Characteristic, Layout, and Site Position within Broader or Mixed-Use Location.

-

Locations that Appeal to Diverse Tenant Types.

-

Sites with Potential for Value Creation.

-

Smaller Asset Size.

Why Our Outparcels?

.

-

Target Well-Located Outparcel Properties While Maintaining a Highly-Diversified Portfolio.

-

Broad Market Relationships Drive Acquisition Pipeline.

-

Consistent Internal Growth through Long-Term Net Leases with Strong Contractual Rent Escalations.

-

Proactively Manage Our Portfolio.

-

Actively Manage Our Balance Sheet to Maximize Capital Efficiency.

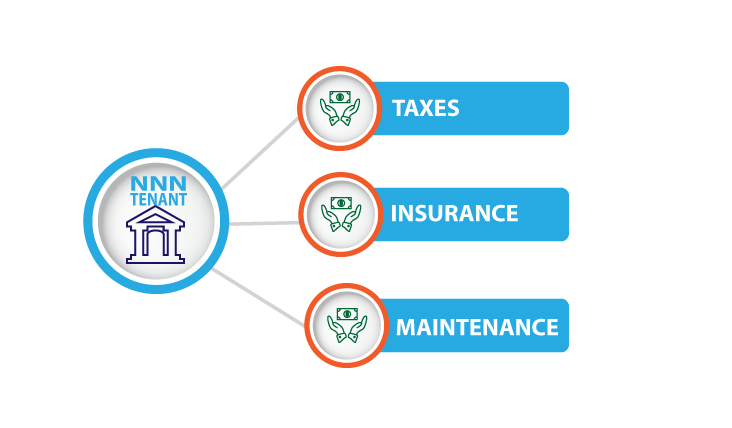

What Is A Net Lease?

.

-

Triple net leases require leasee tenants to pay real estate taxes, property insurance, and operating expenses which protects landlords from rising costs.

-

Double net leases require leasee tenants to pay real estate taxes and property insurance.

FrontView REIT Has Transacted With the Outparcel Tenants Below

FrontView REIT Leadership

FrontView REIT’s leadership has 20+ years in real estate and/or net lease real estate experience

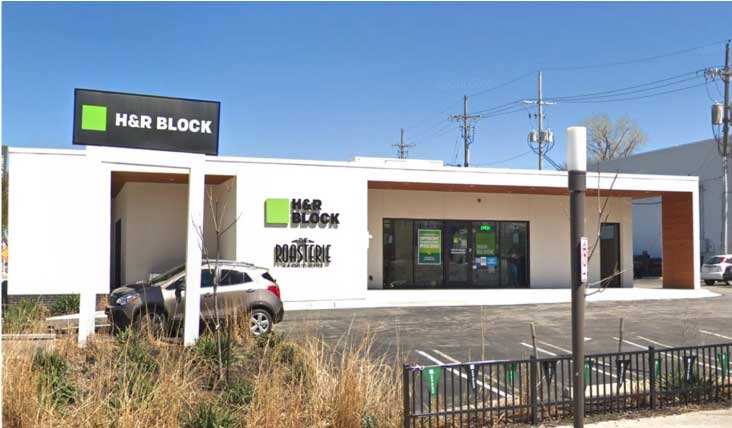

FrontView REIT Sample Acquisitions

FrontView REIT continues its acquisition strategy of assembling a hand-selected national portfolio of outparcel properties.